By Alex Philippidis

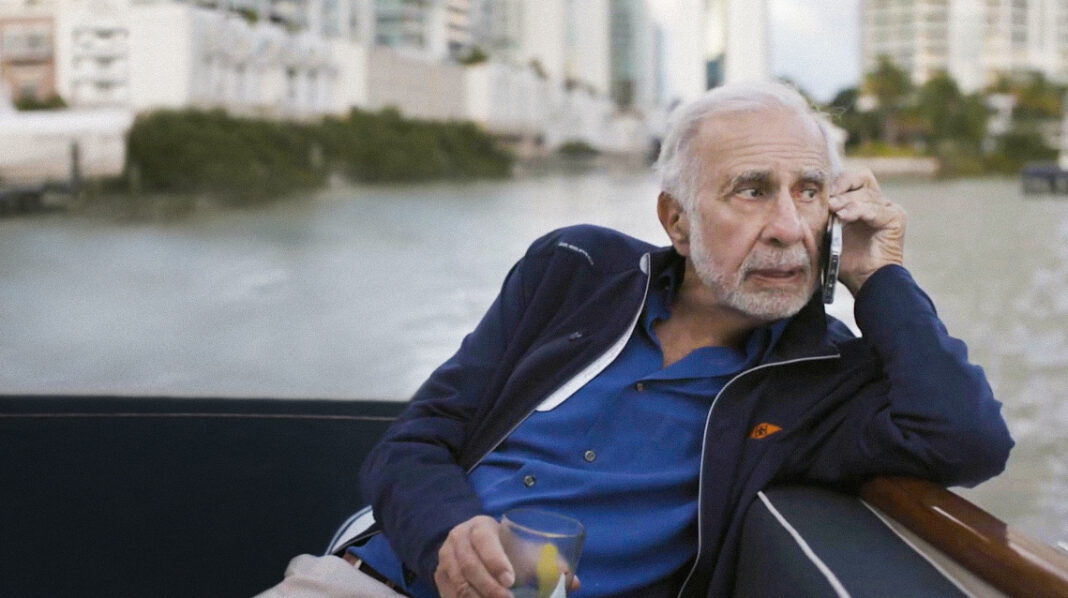

Carl C. Icahn has launched the next phase of his campaign for change at Illumina through a lawsuit filed this week in Delaware against former CEO Francis deSouza and board members.

Icahn’s lawsuit alleges that deSouza and board members breached their financial duty by directing Illumina’s three-year effort to acquire cancer blood test developer Grail, as well as the company’s defense of the $7.1 billion deal in the face of opposition from U.S. and European regulators.

The lawsuit comes four months after deSouza resigned as CEO following a proxy challenge from the activist investor that was partly successful. Shareholders of the sequencing giant ousted a deSouza ally as chair and elected to the board one of three allies nominated by Icahn.

The lawsuit was filed Tuesday in Delaware Chancery Court. However, the complaint on which the suit is based is not public and will not be until next week. The court allows complaints to be kept confidential pending potential redactions to be proposed by lawyers for Icahn and the defendants.

Illumina spokesman David McAlpine told GEN today that Illumina was reviewing the complaint.

Illumina investors appeared somewhat fazed by news of Icahn’s lawsuit. Shares of Illumina fell nearly 6% today, from $131.87 to $124.45. Shares of Icahn’s publicly-traded Icahn Enterprises stayed flat, inching up 0.5%, from $17.77 to $17.86.

Icahn disclosed his lawsuit yesterday during a “fireside chat at the 13D Monitor Active-Passive Investor Summit, a conference focused on shareholder activism; corporate governance; environmental, social, and governance (ESG) concerns.

“Throughout my long, long career as an activist, I have never found it necessary, until today, to sue a board of directors in this manner,” Icahn told the conference, according to Bloomberg News. “I continue to believe in the company’s long-term potential and I have full faith in Illumina’s new CEO, and its employees.”

In a statement Wednesday, Icahn said he decided to pursue the lawsuit because of “the board’s unconscionable and egregious actions relating to closing the acquisition of Grail without regulatory approval, thus putting Illumina, a great company, in harm’s way.”

Icahn has voiced public support for deSouza’s successor Jacob Thaysen, PhD, who became Illumina’s CEO effective September 25. While some market watchers questioned Thaysen’s lack of past CEO experience, Icahn posted on X, formerly Twitter: “I think he will do an excellent job and he has my full support.”

deSouza’s resignation marked the second victory for Icahn in his effort to change the direction of Illumina’s management by reshaping its board. The first came in May, when Illumina shareholders ousted chairman John W. Thompson, who had ties to deSouza, and instead elected to Illumina’s board Andrew J. Teno, a portfolio manager at Icahn’s investment management firm Icahn Capital since October 2020.

Icahn’s case for change

During more than two months of open letters to Illumina shareholders—and in an exclusive interview on GEN’s “Close to the Edge” video series, Icahn and Teno stated their case for change at Illumina. That case rested on three key arguments:

- Illumina drained itself of resources by acquiring Grail and challenging regulators.

- Illumina’s stock price had shrunk to the point where the company had lost some $50 billion in market capitalization—the share price times the number of outstanding shares of a public company.

- Illumina’s board nearly doubled deSouza’s total compensation last year, to almost $27 million, with much of that increase based on stock options.

Speaking with GEN in April, Icahn cited an instance of what he considered a breach of duty by Illumina’s board—its decision to increase its insurance protection to board members before they approved the purchase to what he has termed an unprecedented level. That decision, Icahn concluded in March, reflected board reluctance to support the Grail acquisition absent additional personal liability protection above existing protections.

“This board realized—they must have—how crazy this was. So, they’re supposed to use their business judgment, their duty of loyalty, their duty of care. They didn’t use it,” Icahn said.

“If they were really lax to do a business judgment, and so if that is found, insurers may not cover them. But the board doesn’t seem to care,” Icahn lamented. “It’s a very, very interesting and strange situation. I’ve never seen one as bad as this, and I’ve been around a long time.”

Potential conflicts

Icahn has also raised the question of potential conflicts by deSouza and Illumina’s board between their duty to shareholders and their actions in the Grail acquisition—potential conflicts that he told shareholders on May 8 justified requesting a fairness opinion from an independent financial expert.

Icahn cited as one example deSouza’s years of personal friendship and professional relationships with John W. Thompson, a Grail shareholder who served as Illumina’s board chair from 2021 until he was ousted by shareholders in May.

Another example was Goldman Sachs’ role as Illumina’s financial advisor after having served as a lead underwriter for Grail in an attempted initial public offering (IPO) that it aborted when Illumina agreed to buy the company in 2020, saying the deal would accelerate the commercialization of its Galleri™ blood detection test, then being planned for launch in 2021.

In his May 8th letter, Icahn also introduced the possibility of a lawsuit: “We believe there are likely many more red flags [emphasis in original] that will be revealed if and when the members of Team Francis are forced to sit for depositions.”

During the GEN interview, Teno contrasted deSouza’s relationships with Thompson and the presence on the board of other deSouza allies with the traditional separation of powers between CEOs and board chairs: “Francis is picking the people he wants to be on the board and pushing them through his committee.”

Asked if the moves constituted too close a link between chairman and CEO, and thus a breach of fiduciary duty, Teno replied: “If you hired your friend of 20 years, you’ve known someone for 20 years, do you think they treat them a little differently than you treat someone you don’t know? I think the answer is absolutely. That’s why they have the separation of powers.”

Alex Philippidis is Senior Business Editor of GEN.